A mortgage, one of many big life decisions, can be daunting until we get to grips with what exactly needs to be done to attain it. At the beginning, it’s difficult to know just where to start with it all.

Mastering your mortgage is something most people wouldn’t even try to contemplate in the early stages of the process, but Drogheda Credit Union wants to change that!

Drogheda Credit Union’s Mortgage Expert, Mark Smith, has put together a guide to mastering your mortgage, an essential checklist to help you become mortgage ready, and have you in your dream home much sooner than you think!

A guide to mastering your mortgage

- Identify how much of a mortgage you are eligible to borrow- It’s important to know the figure you can borrow at an early stage to ensure you don’t get your hopes up when looking at houses. Drogheda Credit Union can help you to calculate this figure easily using their mortgage enquiry form, which is available on droghedacu.ie

- Speak to a dedicated Mortgage Advisor – Be practical, talk to a financial provider such as Drogheda Credit Union who can advise you about what is the best course of action for you to take on your mortgage journey. There is a lot of criteria to meet when it comes to getting a mortgage so having a good handle on this early on really helps speed up the process.

- Start Saving– It’s a must when it comes to starting your mortgage journey. Start saving as early as possible and establish regular monthly savings for a period of at least 6 months. It’s important to demonstrate your repayment capacity and helps accumulate funds towards your deposit.

- Prepare the Paperwork – It helps if you organise the paperwork required before applying for your mortgage. Many lenders like Drogheda Credit Union can provide you with a mortgage checklist and take you through the various documents that will be required.

- Factor in Extra Costs – When buying a property there are always additional fees that first time buyers don’t factor into their home costs. Valuation fee, stamp duty, home insurance, estate agents fees, legal fees, property tax are all ones to be aware of when totting up your figures.

If you already have your Mortgage but considering a switch, then Drogheda Credit Union should be on your list. As interest rates continue to rise across the banking sector, it’s important to remember that Drogheda Credit Union is not linked to the ECB, which means that that no sudden rate increases will apply.

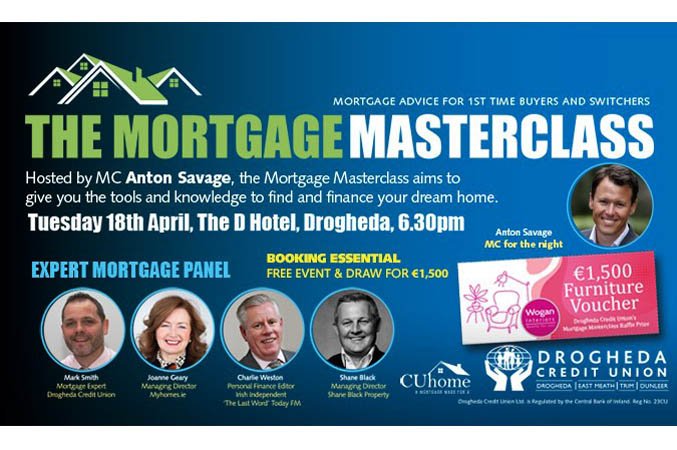

If you want to learn more about Mastering your Mortgage you can attend Drogheda Credit Union’s Mortgage Masterclass on Thursday, 18th April 2023 in The D Hotel, Drogheda from 18:30 – 20:30.

Hosted by presenter Anton Savage, the Mortgage Masterclass aims to help you find and finance your dream home. Our expert panel includes Charlie Weston, Personal Finance Editor, Irish Independent; Mark Smith, Senior Loans Officer, Drogheda Credit Union; Joanne Geary, Managing Director, MyHome.ie and Shane Black, Managing Director, Shane Black Property.

Tickets to attend the event are available on the Drogheda Credit Union website at: www.droghedacu.ie/mortgagemasterclass